The entrepreneurial landscape is rife with startups fearlessly tackling traditionally stringent industries. These innovative companies, often utilizing cutting-edge technology, aim to disrupt established models while simultaneously conforming to a complex web of regulations. This delicate balance presents a unique set of challenges and opportunities for startups existing in these sectors.

- In Spite Of the inherent complexities, many startups are achieving success by embracing a flexible approach to compliance. Their frequently restructure traditional frameworks, utilizing novel solutions that concurrently satisfy legal obligations and promote growth.

- Moreover such startups are frequently at the forefront of industry trends, helping to a more responsible future.

This highlight a increasing trend of startups redefining the regulatory landscape, revealing that disruption and compliance could coexist in a mutually productive manner.

Balancing Innovation and Governance: A Startup's Handbook to Success

Navigating the landscape of entrepreneurship can be a challenging task, especially for startups. While the drive to transform is at the heart of every successful venture, it's crucial to understand the importance of guidelines. These frameworks are in place to ensure both consumers and businesses, creating a level playing field. Startups must endeavor to master this delicate balance, utilizing innovation while remaining compliant to regulatory norms.

This requires a strategic approach that encompasses continuous communication with relevant authorities. By fostering these relationships and showcasing a commitment to openness, startups can thrive in an sphere that both encourages and regulates innovation.

Navigating this Regulatory Labyrinth: Challenges and Opportunities for Startups in Controlled Sectors

Startups venturing into regulated sectors often find themselves embarking on a complex regulatory labyrinth. Strict regulations, designed to ensure safety and conformity, can present significant obstacles to innovation and growth. Startups must consistently demonstrate responsiveness throughout their operations to obtain the necessary permits. {However|,On the other hand, this regulatory environment also presents promising prospects for startups that demonstrate a deep understanding of legal obligations. By adapting to these regulations, startups can establish credibility in the market.

A successful approach involves intentionally engaging with regulatory bodies, seeking guidance, and regularly monitoring legal developments. ,Furthermore, startups can leverage technology to streamline their operational procedures and strengthen their overall adaptability. By navigating the regulatory labyrinth effectively, startups in controlled sectors can prosper.

The Battle Between Tech Giants and Legacy Institutions: Startups in a Controlled Landscape

In transforming landscape of modern business, startups face significant obstacles. Navigating the ambitions of ambitious tech titans and the restrictions imposed by traditional gatekeepers in highly regulated markets requires strategic maneuvering. While tech giants often disrupt industries with agility, their influence can create the established norms and regulations that govern many sectors. , Thus, startups must develop strategies for this complex ecosystem, leveraging both the power of technology and a deep understanding of regulatory frameworks.

- Startups aim to achieve success in these complex environments, startups need to adopt a multifaceted approach that embrace collaboration with both tech giants and regulatory bodies.

- , Additionally, the rise of copyright presents both opportunities and challenges for startups in regulated markets.

Ultimately, the future of startups in regulated markets will depend on their willingness to collaborate, coupled with the emergence of new technologies.

Regulatory Sandboxes: Fostering Innovation While Protecting Consumers

Regulatory sandboxes offer a unique approach to fostering financial technology development while mitigating potential risks to consumers. These controlled environments allow firms to test new products and services in a simulated setting, under the supervision of regulators. By providing this platform, sandboxes can help stimulate innovation while ensuring that consumer interests remain paramount.

The benefits of regulatory sandboxes are extensive. For startups, they provide a valuable opportunity to experiment their ideas in a practical setting, reducing the risk of failure and attracting investment. Regulators, on the other hand, can assess these new products and offerings closely, identifying potential challenges early on and implementing necessary modifications. This collaborative approach fosters a thriving ecosystem where innovation can flourish while safeguarding consumer confidence.

From Seed to Scale: Funding Strategies for Startups in Regulated Industries

Securing investment for startups operating within regulated industries can present a unique obstacle. Unlike established sectors, these ventures often face intricate regulatory structures that affect their ability to attract investors. To navigate this landscape successfully, startups must implement strategic funding strategies tailored to their specific circumstances.

A key starting point is identifying the appropriate capitalization phase. Early-stage ventures check here may rely grants, angel investors, or incubators to propel initial expansion. As the business matures, it can explore alternatives such as debt financing, private equity, or even IPO to support further acceleration.

Establishing a strong relationship with financial advisors is also crucial for startups in regulated industries. These stakeholders can deliver invaluable knowledge on navigating the legal framework and enhancing the company's reputation.

It is important to remember that the journey from seed to scale in regulated industries requires tenacity.

Startups must demonstrate a deep grasp of the relevant regulations, a dedication to compliance, and a clear plan for market penetration.

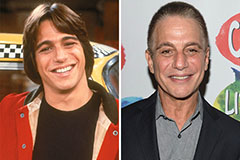

Tony Danza Then & Now!

Tony Danza Then & Now! Brandy Then & Now!

Brandy Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!